Think You Can Only Use Your VA Benefits Once…Think Again!

Before we begin, we would like to thank you for your service! It’s important to know that whether you’ve served in the U.S military (you’re a Veteran) or you’re an active duty Service member you should not miss out on the VA benefits that you have earned.

Before we begin, we would like to thank you for your service! It’s important to know that whether you’ve served in the U.S military (you’re a Veteran) or you’re an active duty Service member you should not miss out on the VA benefits that you have earned.

The homeownership rate amongst veterans is considerably greater than that of civilians but this can take a financial toll on these veterans. It can make it hard for some to get a financial hold not to mention a home loan. However, the good news is there are programs out there to help veterans including what is perhaps the most powerful home loan on the market to financial protection and more.

Ever since the VA loan program’s conception in 1944, the Department of Veterans Affairs has financed more than 21 million loans for veterans, active-duty military members, and their spouses. Currently out of 22 million eligible vets and active duty personnel only approximately 2 million are currently using these well-deserved benefits. This program has made purchasing a home more available to those who most deserve the American dream they helped protect and build.

Overview of the Requirements for VA Loans

Potential VA homebuyers must meet requirements set by the Department of Veterans Affairs and by the lender they work with to get financing. The VA does not make home loans themselves, so lenders can have their own conditions along with the VA’s requirements.

General Requirements

To obtain a VA loan, the law requires that:

- The applicant must be an eligible veteran or active duty personnel who has available entitlement.

- The loan must be for an eligible purpose.

- The veteran must occupy or intend to occupy the property as a home within a reasonable period of time after closing the loan. There are workarounds and exceptions in some cases. Talk with a lender about your appropriate occupancy status.

- The veteran must be a satisfactory credit risk.

- The income of the veteran and spouse, if any, must be shown to be sufficient and stable to meet the mortgage payments, cover the costs of owning a home, take care of other expenses and obligations, and have enough left over for family support.

Credit & DTI Ratio

The VA doesn’t require a specific credit score for veterans and military members who want to use this benefit. Though a lender typically will, and requirements can be different amongst lenders.

Residual income

VA also has a requirement for residual income, or monthly income remaining after all major obligations and debts are paid. Residual income is measured to ensure borrowers and their families will have enough money to cover basic living costs (e.g. food, transportation), and values vary based on family size and part of the country. The VA loan program’s success in terms of low foreclosure rate is due in part to these residual income requirements.

Benefits of VA Home Loans

Even though the requirements may look complicated, millions of veterans and service members are eligible for a VA home loan. When hunting for a mortgage, veterans should consider the major benefits and perks of using a VA home loan. Did you know VA home loans have boomed in recent years, attracting many veterans and military members who may not qualify for conventional loans, which have stricter credit requirements?

Complete List of VA Loan Benefits

Eligible homebuyers are not obligated to have a down payment in most cases – widely regarded as the greatest VA loan benefit! Conventional loans generally require a 5 percent down payment, and FHA loans require 3.5 percent.

- No monthly mortgage insurance premiums or PMI to pay. FHA loans come with both an upfront and an annual mortgage insurance charge. Conventional buyers typically need to pay for private mortgage insurance unless they’re making a down payment of 20 percent or more.

- Limitation on the buyer’s closing costs. Sellers can pay all of a buyer’s loan-related closing costs and up to 4 percent in concessions.

- Lower average interest rates than other loan types. VA loans continue to have the lowest average interest rates of all loan types.

- No prepayment penalties. VA buyers can pay off a loan early without any financial penalties.

- Two refinance options. The VA loan program allows homeowners with existing VA loans the option to lower their monthly payment with a new interest rate. Eligible homeowners who financed their property with a loan other than a VA loan can refinance into the VA loan program.

- Second tier entitlement. Even though many veterans have already used their loan benefits, it may be possible for them to buy homes again with VA financing using remaining or restored loan entitlement.

- An assumable mortgage, typically subject to VA and/or lender approval. You may be able to have someone take over your mortgage payment, which can be a big benefit in an environment of rising interest rates.

The purpose of the VA home loan program is to help those who served finance affordable housing. Despite its Minimum Property Requirements, the VA cannot, however, guarantee that you are making a good investment, or that you can resell the house at the price you paid. The VA does not have authority to provide you with legal services.

Properties You Can Purchase with a VA Loan

VA home loans are made by a lender, such as a mortgage company, savings and loan or bank. The VA’s guaranty on the loan protects the lender against loss if the payments are not made, and is intended to encourage lenders to offer veterans loans with more favorable terms.

VA loans have a lot of big benefits, from no down payment or mortgage insurance to lower average interest rates and limits on closing costs.

What can a VA loan be used for?

- To buy a home, including townhouse or condominium unit in a VA-approved project.

- To build a home.

- To buy a manufactured home or modular home. Most lenders are hesitant to offer these loans.

- To buy a multiunit property, typically up to a four-plex, provided you live in one of the units

- To refinance an existing home loan up to 100 percent of the home’s value in some cases or to refinance an existing VA loan to reduce the interest rate.

The VA loan program

Nevertheless, many eligible buyers are unaware of the benefits of VA home loans and the protections they offer. Some buyers also make the mistake of expecting a government-backed loan comes with endless red tape and miss an opportunity to benefit.

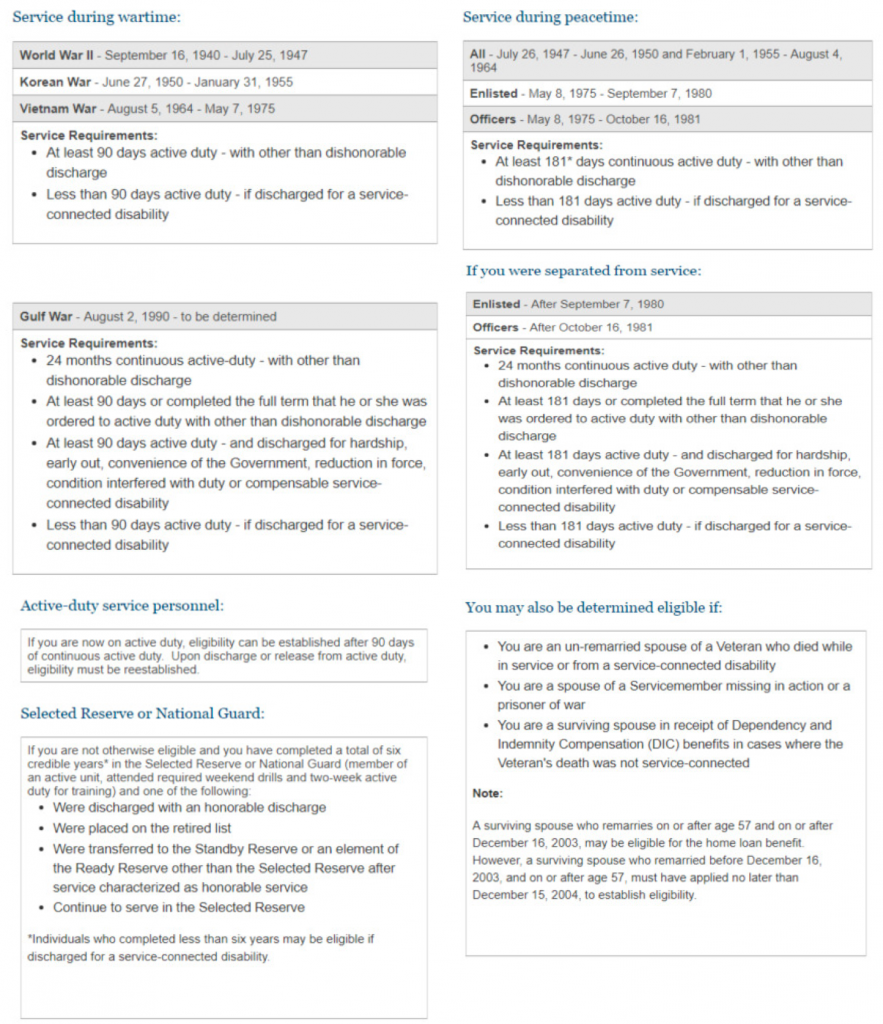

Normally, veterans and active-duty service members are eligible for a VA home loan if they served in the following capacity (excluding training time):

- 90 consecutive days on active duty during wartime

- 181 consecutive days on active duty during peacetime

- 6 or more years in the National Guard or Reserves

- Some spouses of military members who died in the line of duty or of a service-related disability may also be eligible for a VA loan. Talk with a VA lender about obtaining your Certificate of Eligibility and getting a sense of your purchasing power.

Occupancy & power of attorney

VA loans are centered around getting buyers into homes they’ll live in full time. But the program offers exceptions for some veterans and active-duty service members.

For example, a spouse or children may be able to fulfill the occupancy requirement on behalf of a VA buyer. Also, a VA buyer who is deployed or otherwise unable to manage the loan process can typically assign a power of attorney to a spouse or family member to manage the loan process and sign documents.

There are two types of power of attorney: general and specific. The type needed depends in part on what loan-related documents the VA buyer can sign.

The power of attorney and occupancy options mean an eligible VA buyer’s spouse and children could buy a home during a deployment or unaccompanied assignment, helping ease the emotional burden of multiple moves on military families.

Basic Allowance for Housing (BAH)

Many active-duty military members who get a monthly housing allowance are shocked to learn that they can use this money to qualify for a home loan. Lenders can count BAH as effective income. That can help service members make the jump from renting to owning, especially in higher-cost areas.

BAH is based on several factors, including the location of your duty station, your pay grade, and your family size. The housing allowance can change on an annual basis. To calculate your BAH, refer to the BAH calculator on the Defense Department’s website.

Financial protections

Even after becoming homeowners, active-duty service members can meet unique financial challenges. Deployment and changes of a station can hurt a family financially and emotionally.

The Service members Civil Relief Act (SCRA) provides active-duty military personnel and their families’ financial protection involving interest rates, income tax payments, eviction, foreclosure, and more.

For example, military personnel can ask creditors (including their mortgage lender) to cap their interest rate at 6% during their term of service. The SCRA also makes lenders and servicers to seek a court order to foreclose on active-duty military members during their time of service and up to nine months afterward.

Veterans Affairs also offers foreclosure avoidance protection assistance for homeowners. The VA has a team of experts who work with servicers and lenders on behalf of struggling homeowners to find other options to foreclosure. Their efforts have helped nearly 500,000 veterans and service members avoid foreclosure in the past six years alone.

FAQs from buyers about the VA Mortgage

Q: I served in the military, will I be able to get a VA Mortgage?

A: The Department of VA will guarantee a loan to anyone who is active in the military or a veteran that has served the required amount of time

Q: What is the required amount of service time to be eligible for a VA Mortgage?

Q: What military documents do I need to prepare to get a VA Mortgage?

Q: I don’t know if I can find my documents from when I served, how would I reclaim them?

A: Here are three websites that should be able to help you out:

- http://vetrecs.archives.gov/

- http://www.archives.gov/veterans/military-service-records/

- https://www.ebenefits.va.gov/ebenefits/homepage

*If you have difficulty reclaiming your information from any of these sites, the local recruiting office for your branch will be able to assist you.

Q: I have my discharge paperwork but I need help getting my Certificate of Eligibility (COE)

A: Reach out to your local lender, they will be able to help..

Q: I served a very long time ago, do my VA benefits for a mortgage expire?

A: In short, No. The VA Home Loan benefits never expire. Once you have served, you can use your VA benefit as long as you’re alive.

Q: I used my VA mortgage a very long time ago to buy a home. Will I be able to do it again?

A: The VA Mortgage can be used several times over and over again. As long as the previous home was sold, your entitlement should be fully reinstated.

Q: What is the highest loan amount for a VA Mortgage?

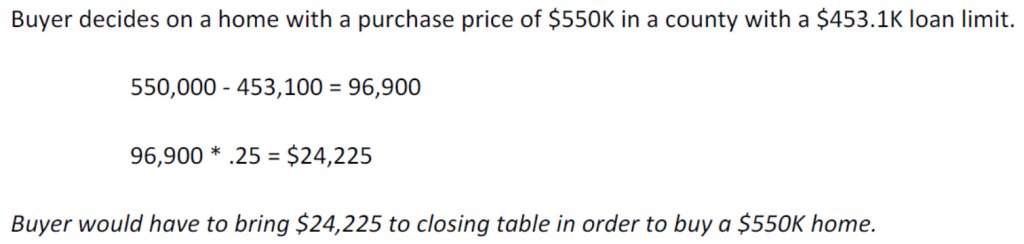

A: The highest loan amount is based by county, but in most counties, unless expanded loan limits apply, the maximum loan with about no money down is $453,100. You actually can borrow any loan amount you like, you will just be responsible for 25% of the borrowed amount that is over the county loan limit.

Q: I heard that other mortgage types were not as expensive as a VA Mortgage?

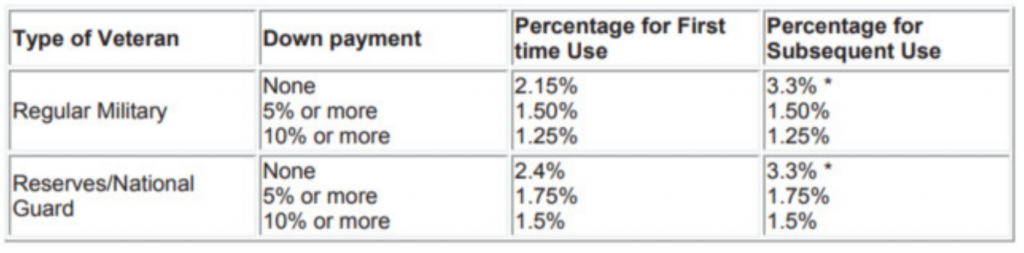

A: There is a compulsory funding fee on all VA mortgages (unless the borrowing veteran is receiving a VA related disability, then the funding fee is waived) the funding fee is built over and above the loan amount and the fees are shown below:

Q: What is the minimum credit score to get a VA Mortgage?

A: The VA does not have a minimum credit score, but lenders will have their own internal requirements.

Q: Can I use the VA loan to purchase a condominium?

A: Yes you can. This will be under the same terms as buying a detached single-family residence. Though, you need to check whether the condo association is VA approved. You can check here on this website:

https://vip.vba.va.gov/portal/VBAH/VBAHome/condopudsearch

Q: I relocated and still have a home with a VA mortgage on it. Can I get another VA mortgage?

A: Yes, you can get another VA Mortgage. Your lender will need to calculate your remaining entitlement to compute your highest loan amount with no money down and/or what you would have to put down if you exceed the remaining entitlement.

FAQs from sellers about the VA Mortgage

Q: Do I have to pay a funding fee if the buyer uses a VA loan?

A: No, usually the buyer/borrower will have the VA funding fee added into their loan amount.

Q: Someone told me the appraisal process will be more difficult if I accept a VA offer. Will my house be more scrutinized?

A: This is not true. The laws and process surrounding appraisal independence are almost identical to conventional mortgages. The only item that will sometimes appear during a VA appraisal is if cracked or peeling paint is found somewhere on the subject property. In most states, there will have to be a termite inspection done on the property. However, the cost of that is negotiable between the buyer and seller.

Q: I want to sell my home fast. Does the VA home loan take longer than a conventional mortgage?

A: Definitely not. The compliance laws surrounding disclosures and closing are identical to conventional loans. The lender has some extra tasks they have to perform, but when working with a reliable lender, the timelines and process are exactly the same.

Q: Will I end up paying more fees when I sell to a VA borrower vs. a conventional borrower/buyer?

A: Nope, the fees for title and conveyance are identical, as well as your property tax prorations.

Q: What is the maximum seller concession that can be requested by the buyer using a VA mortgage?

A: Only 4% of the purchase price